Your LicensedPayment Infrastructure Partnerfor Africa

Seamless, Secure, and Scalable Solutions Backed by Trusted Licensed Partners.

About Us

South African-Owned.

Africa-Focused.

Future-Ready.

AfricaPay was founded with the belief that Africa needs its own world-class digital payment infrastructure—built locally, for local realities. With deep roots in South Africa's fintech ecosystem and a footprint expanding across the continent, we bring together compliance, technology, and customer-centricity.

To unlock financial inclusion and enable economic growth by simplifying payments across Africa.

AfricaPay is a licensed Payment Service Provider (PSP) and registered System Operator, compliant with SARB, PASA, POPIA, and FIC regulations.

Comprised of seasoned professionals from payments, banking, compliance, and technology backgrounds, united by a passion to build for Africa.

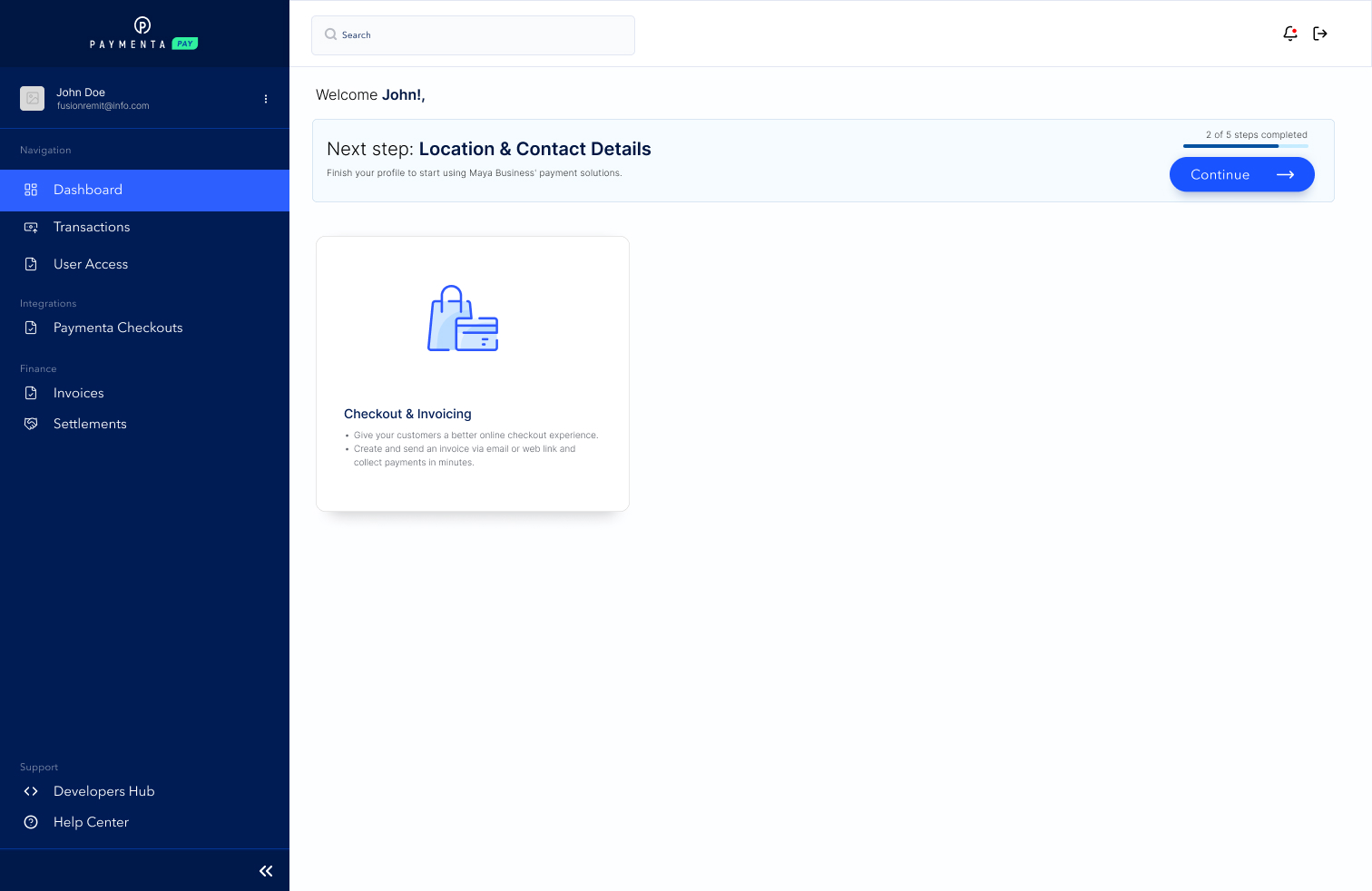

Secure. Scalable. Compliant.

We combine enterprise-grade security, cloud-based scalability, and strict regulatory adherence to give you the confidence to grow and transact across the continent.

Merchant Acceptance

Omnichannel tools to accept payments anywhere, anytime.

Gateway Services

Simple APIs and hosted integrations to power ecommerce and app payments.

Regulatory Compliance

Built-in KYC, AML, and SARB/FIC alignment from day one.

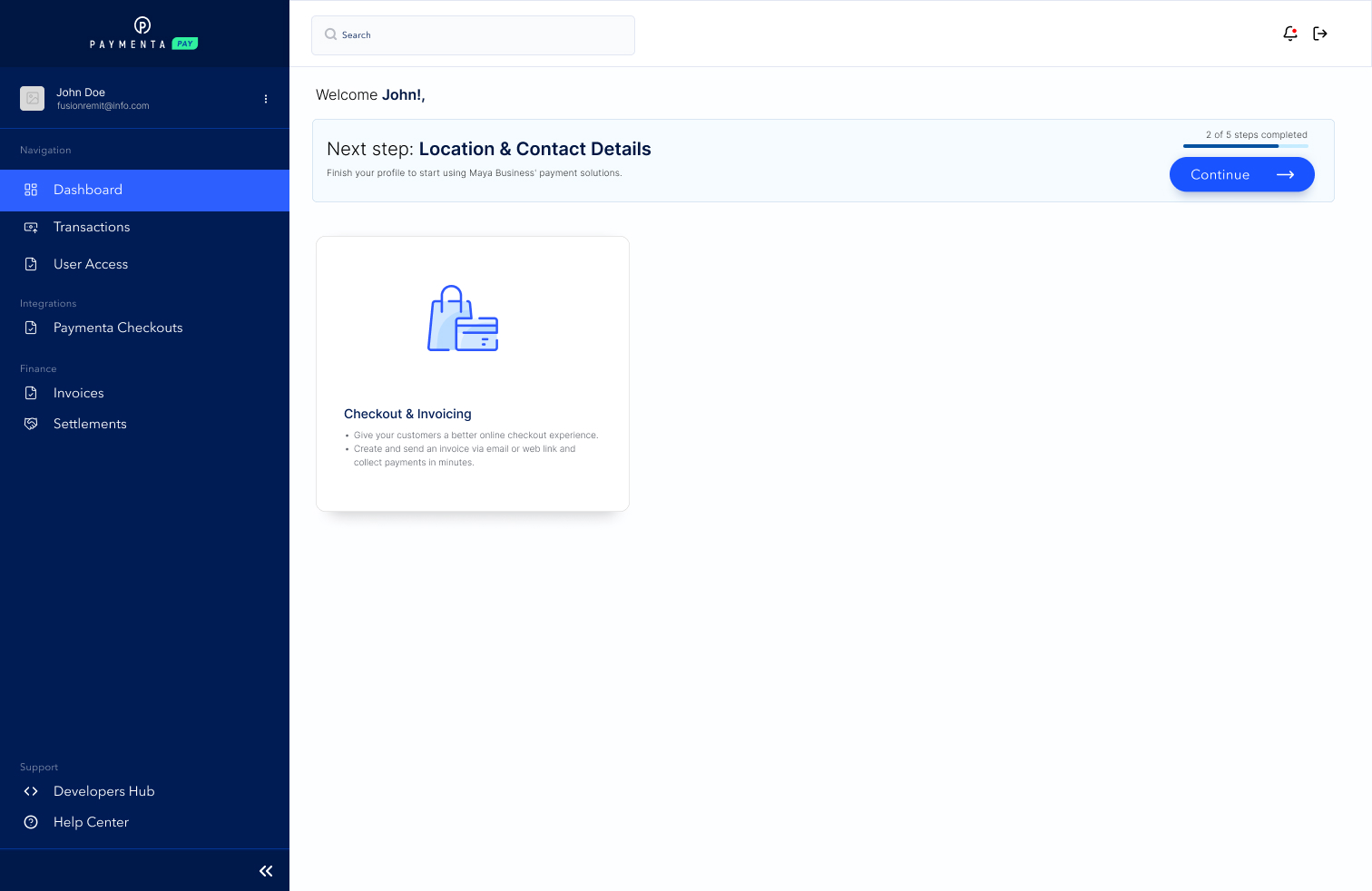

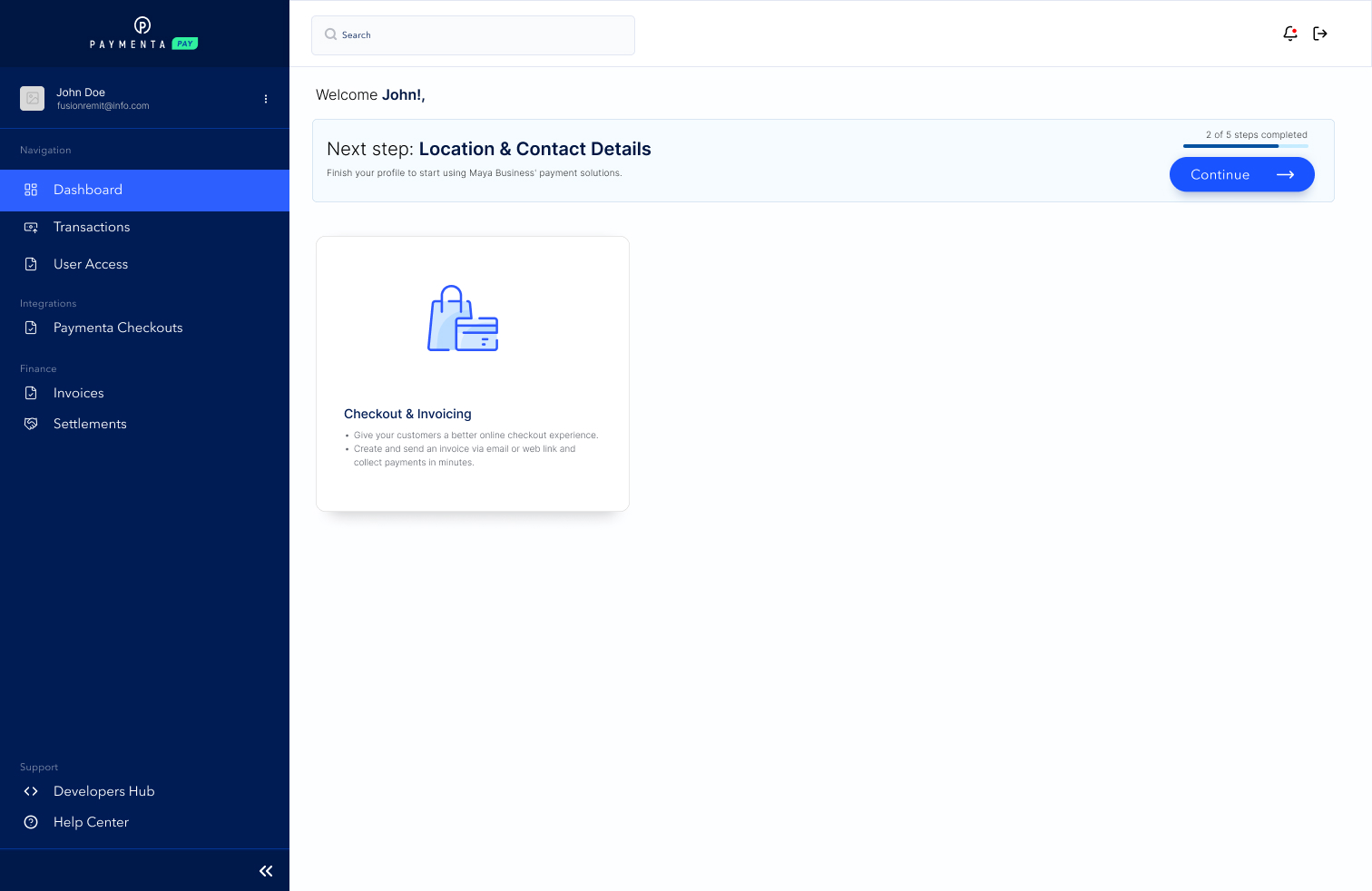

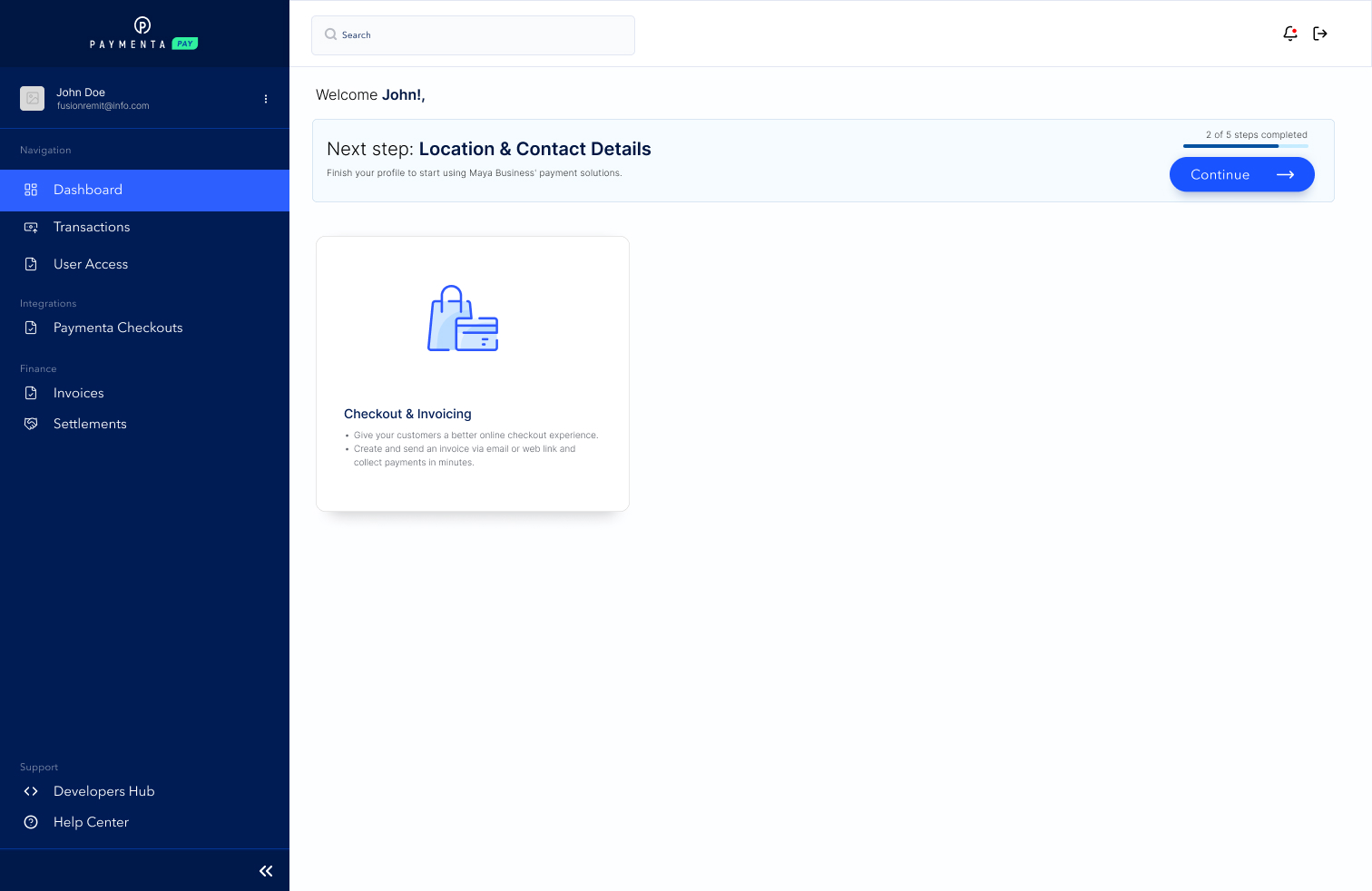

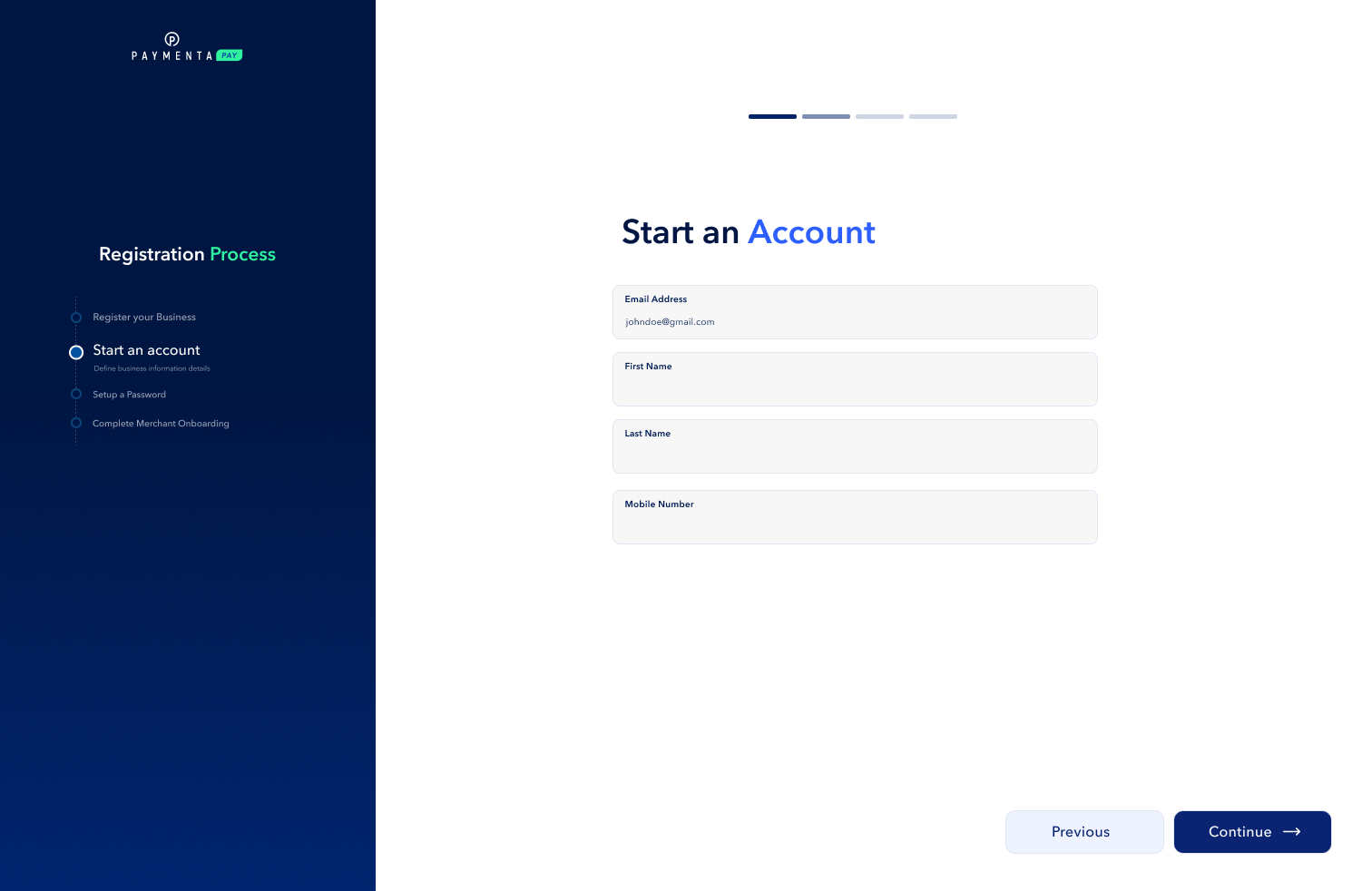

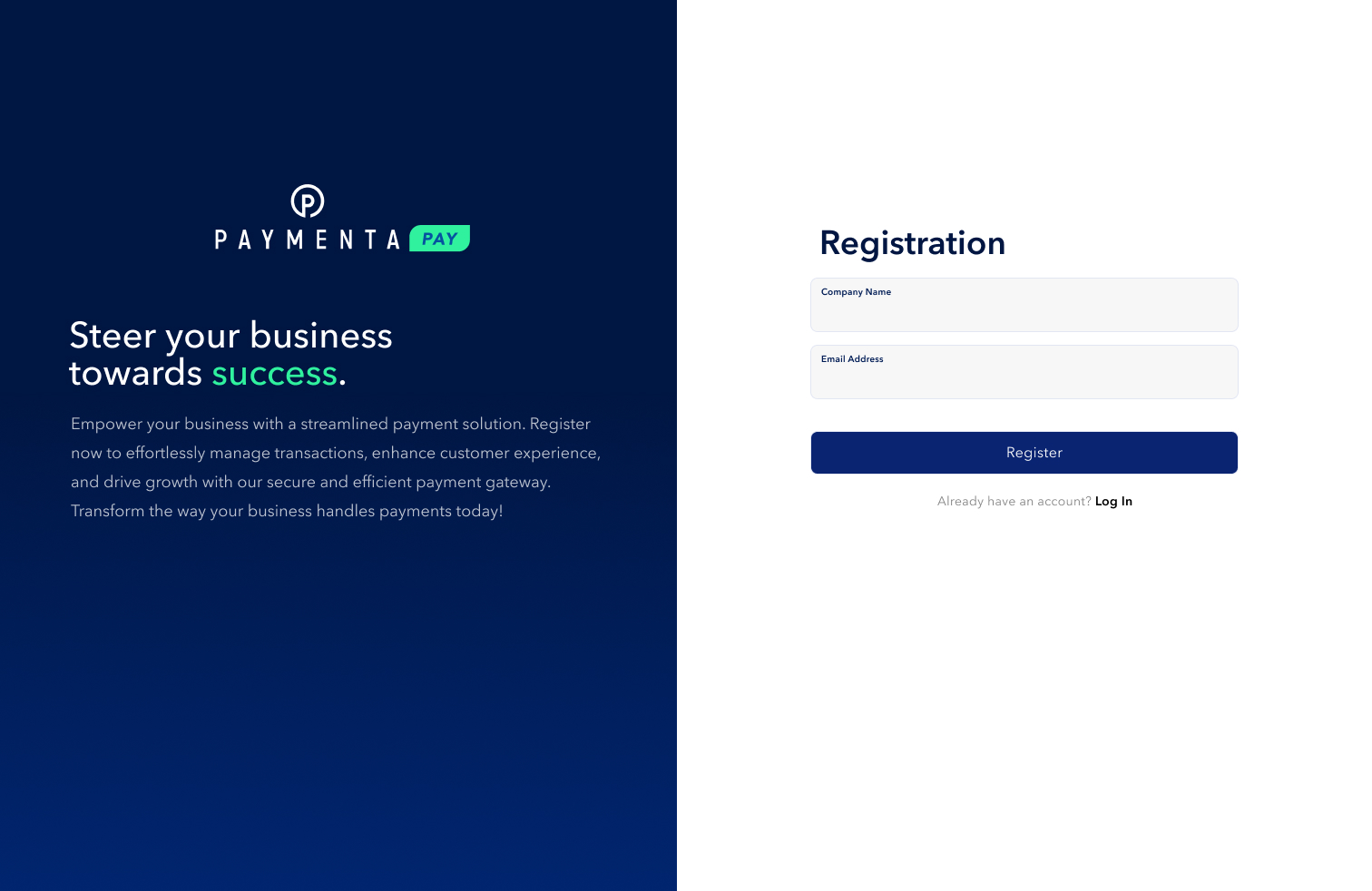

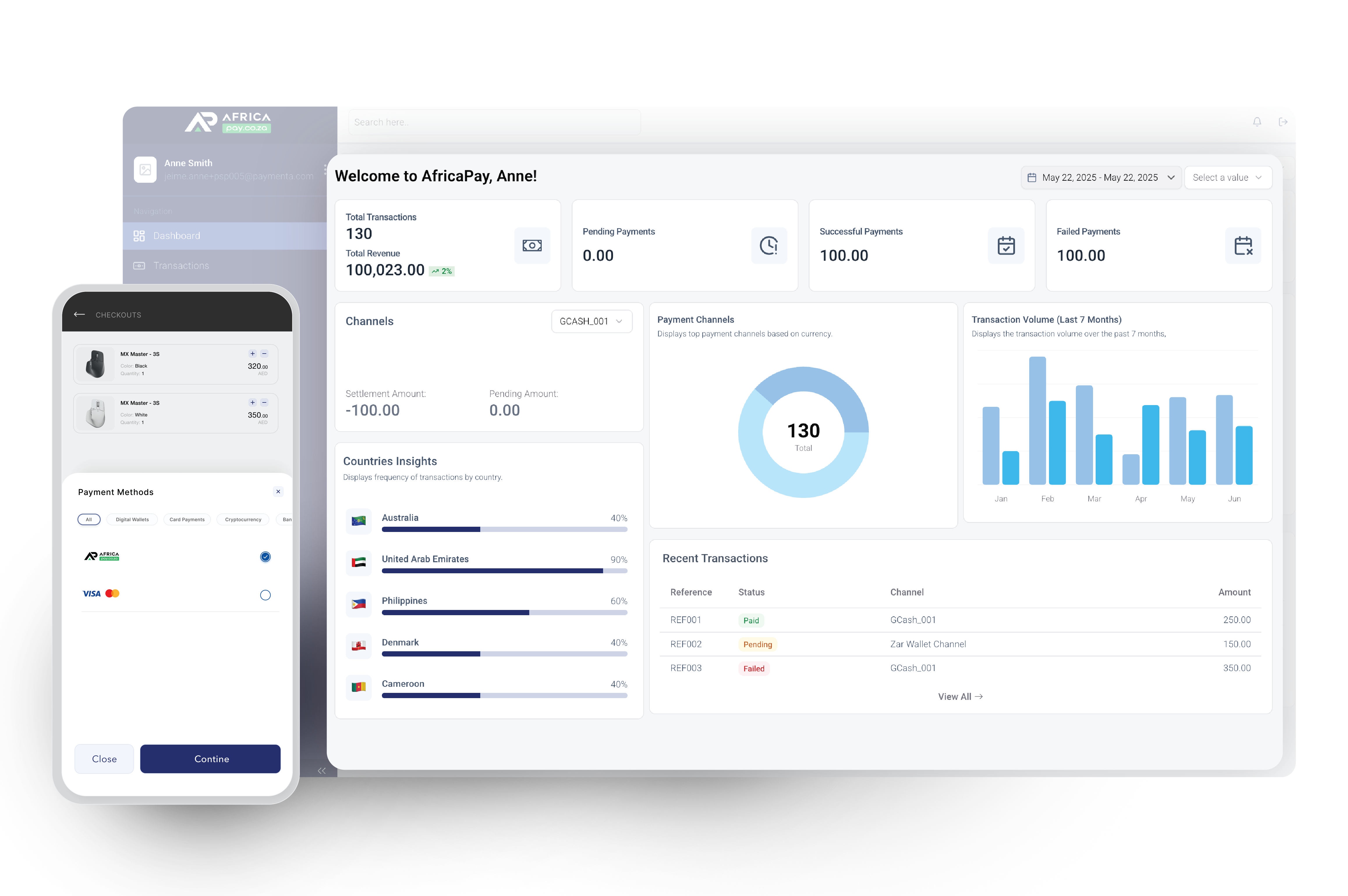

Merchant Services

AfricaPay enables merchants of all types—from informal traders to large retail chains—to accept digital payments across all customer-preferred channels.

What We Offer

Multi-Channel Acceptance

Accept Visa, Mastercard, EFT, SnapScan, Zapper, Apple Pay, Google Pay, and mobile wallets.

Smart POS & SoftPOS

Choose from Android POS devices or convert smartphones into payment terminals.

Instant Settlements

Same-day or next-day settlements with real-time transaction monitoring.

Merchant Segments

Same-day or next-day settlements with real-time transaction monitoring.

SMEs & Informal Traders

Mobile-first solutions with easy onboarding.

Retail & Franchises

Integrated POS with loyalty and inventory support.

Enterprises & Chains

Centralized reporting, reconciliation, and support across branches.

Payment Gateway

AfricaPay's robust payment gateway makes online commerce effortless for developers, ecommerce platforms, and service providers.

Features

Hosted Checkout

Embed a secure, mobile-optimized payment form without writing custom code.

Custom API Integrations

RESTful APIs for tailored checkout flows and backend control.

Pre-built Plugins

Ready-to-deploy plugins for Shopify, WooCommerce, Magento, and custom CMS platforms.

Security & Risk Management

PCI-DSS compliance, tokenization, 3D Secure, and real-time fraud screening.

Multi-Currency Support

Accept and settle in multiple African and global currencies with dynamic FX conversion.

Pay-In / Pay-Out Solutions

AfricaPay was founded with the belief that Africa needs its own world-class digital payment infrastructure—built locally, for local realities. With deep roots in South Africa's fintech ecosystem and a footprint expanding across the continent, we bring together compliance, technology, and customer-centricity.

Capabilities:

Bulk Payouts

Send funds to bank accounts, mobile wallets, and prepaid cards in one click.

Smart Collections

Streamline billing and subscription payments across payment channels.

Split Payments

Automatically split payments between suppliers, partners, and service providers.

Ledger Management

Full visibility of balances, transaction history, and reconciliation records.

Ideal For

Gig platforms, ride-hailing apps, donation platforms, and NGO disbursement schemes.

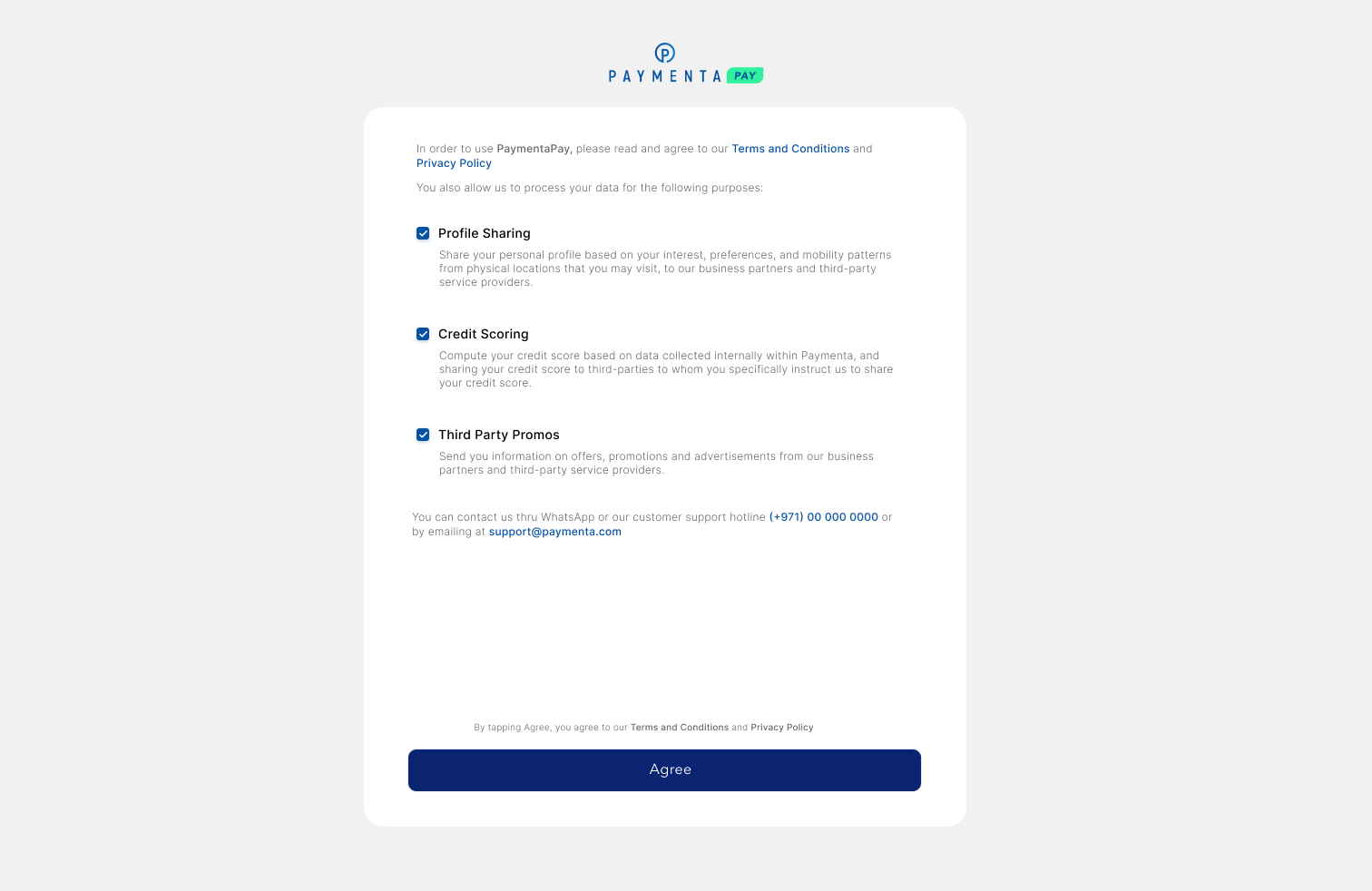

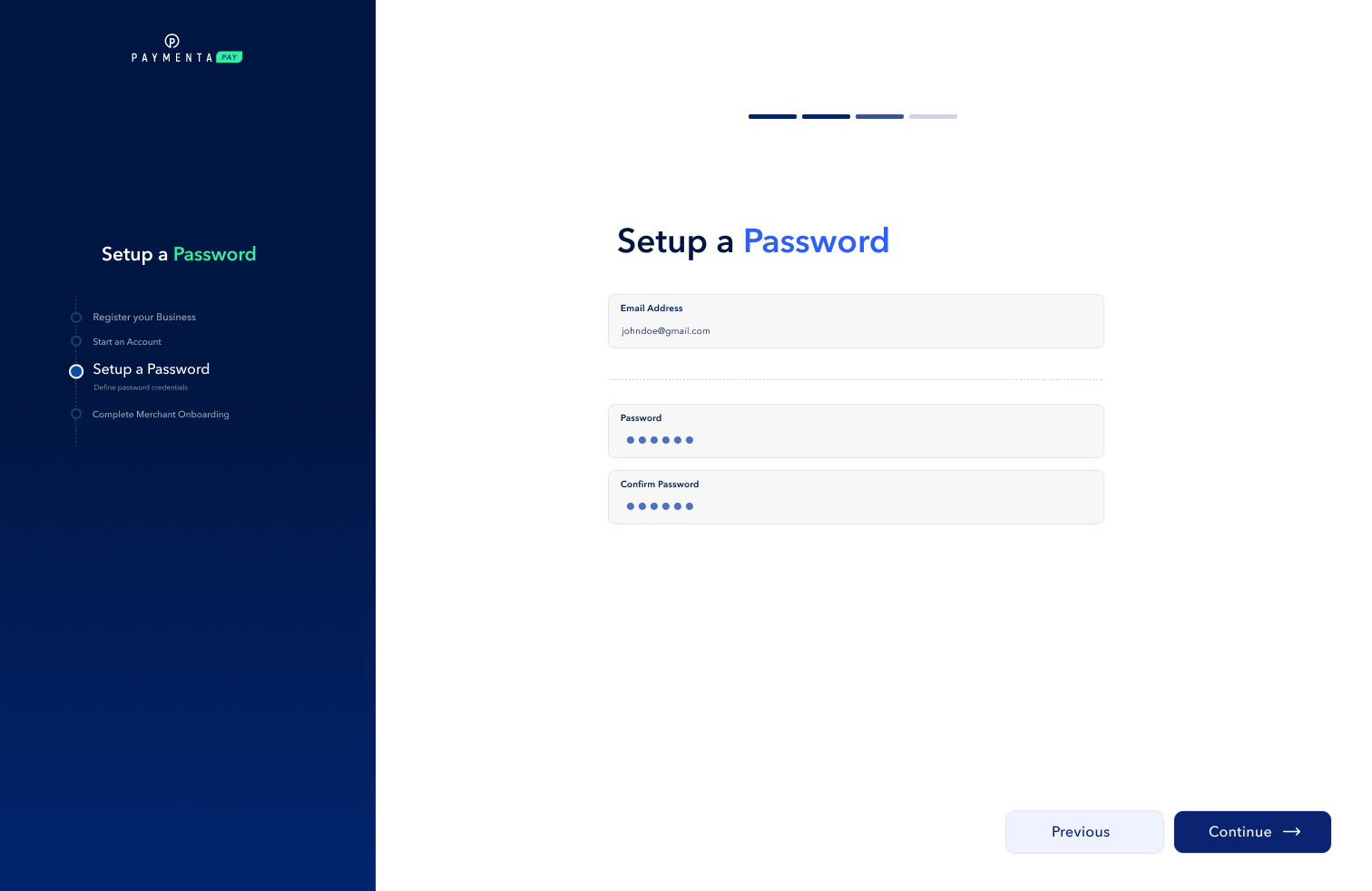

Compliance & Risk

AfricaPay takes a proactive approach to risk and compliance, integrating robust controls into every layer of our platform.

Compliance Tools:

KYC & Onboarding

Automated document capture, biometric verification, and tiered KYC levels.

AML Screening

Real-time checks against global and local sanction lists and behavior-based alerts.

User Permissions

Role-based access, full audit trails, and encrypted communication.

Reporting Automation

Generate SARB, FIC, and POPIA-compliant reports on a daily, weekly, or monthly basis.

Continuous Monitoring

Embedded transaction scoring and anomaly detection powered by AI.

Treasury & Float

AfricaPay gives financial platforms and marketplaces the tools they need to manage liquidity, user funds, and FX exposures across regions.

Treasury Features:

Float Accounts

Interest-bearing float tools with automated funding and rebalancing.

Escrow Framework

Segregated funds structure for client protection and compliance.

Custom Settlements

Define schedules (daily, T+1, weekly) based on your business needs.

FX Management

Real-time visibility and tools to manage currency conversion and transfers.

Cash Management Dashboards

End-to-end treasury visibility with exportable reports.

Industry Solutions

AfricaPay’s flexible infrastructure is tailored to support a wide variety of high-impact sectors.

Sectors We Serve

Fintechs & Wallets

Plug-and-play APIs to power mobile wallets, virtual cards, and agent networks.

Banks & Institutions

White-label payment layers and digital onboarding stacks.

Marketplaces & Aggregators

Real-time routing, split payments, and dashboard control.

Governments & Utilities

Tax collections, license renewals, and subsidy disbursements.

SACCOs & MFIs

Digitized lending flows, deposit collections, and member payouts.

NGOs & Donors

Bulk disbursements with audit trails, limits, and beneficiary KYC.

Let's Build Payment Infrastructure Together

Let’s collaborate to drive the future of digital payments in Africa.